- Manufacturing accounts for £518billion of UK GDP and supports 7.3million jobs reveal new findings due to be launched at MACH 2024 today

- ‘Making things’ accounts for 34.5% of all UK goods and services exports

- Median wage in manufacturing is 11% above the national average

- Call to commercialise more innovations in the UK

Manufacturing is having a far greater impact on the UK economy than first thought according to a major new report released today.

‘The True Impact of UK Manufacturing’, which will be unveiled at MACH 2024 in Birmingham later, shows industry is worth £518billion and supports 7.3million UK jobs directly and across the supply chains/communities it operates in.

This represents nearly a quarter of total GDP (23%) and far bigger than the direct contribution of 8.2% that is usually quoted by economists.

Carried out by Oxford Economics and the Manufacturing Technologies Association (MTA), the in-depth report also shows that ‘making things’ accounts for 34.5% of all UK goods and services exports, whilst the median wage is £31,300 – 11% higher than the national median wage.

The findings are even more impressive when you consider the sector has had to navigate a myriad of challenges outside its control in recent years, including changing relations with the European Union, the Covid-19 pandemic, unprecedented increases in energy costs and global supply chain fragility and international conflicts.

MTA’s Chief Executive Officer, James Selka is now urging the sector to build on this report by exploring ways in which it can address the skills shortage and develop successful programmes, such as the High Value Manufacturing Catapult Centres, to increase wealth creation by commercialising more of the great ideas and innovations born in the UK.

“This is a fantastic insight into the true impact of manufacturing in the UK and reinforces what many of us already know – that industry is a far greater contributor to GDP and jobs than listed in national accounts,” commented James.

“Our report has been designed to take a ‘deeper dive’ and looks at the direct, indirect, and induced impacts of manufacturing, which is a far more comprehensive overview of what we make, the complex nature of our supply chains and the economic benefit gained from the spending of wages by those employed in our sector.”

He continued: “The results illustrate that manufacturing accounts for £518bn of GDP and supports 7.3m jobs, most of which enjoy higher than average wages.

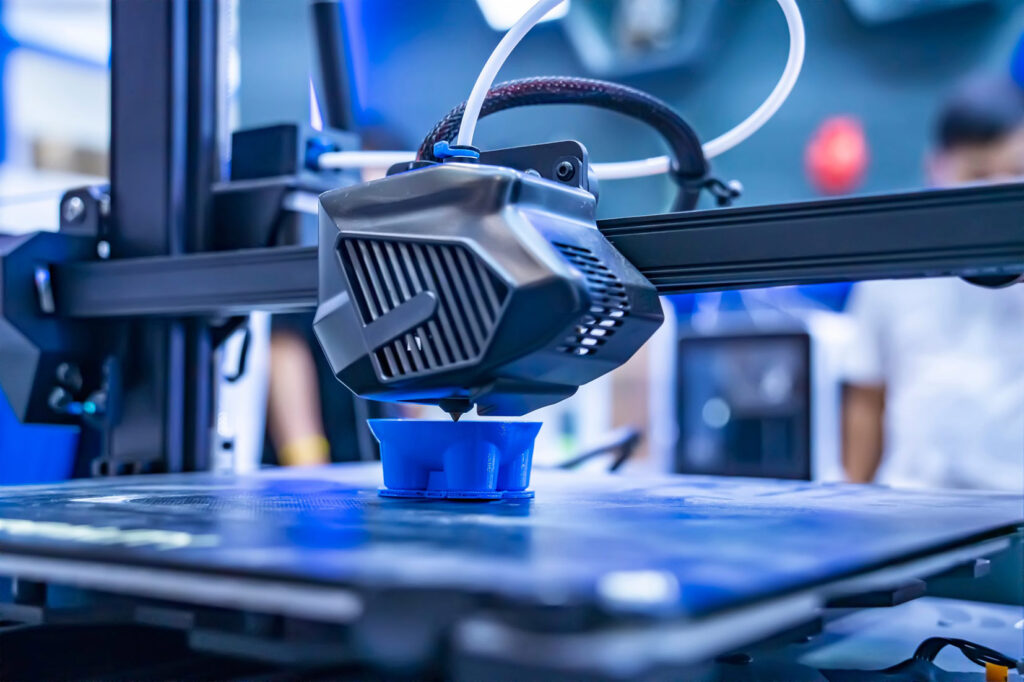

“We are also a part of the economy that invests heavily in new technologies, with nearly half (47%) of total R&D investment made by manufacturers. You only have to visit MACH this week to see this first-hand, with more than 500 companies showcasing the latest in automation and robotics, additive manufacturing, latest software, advanced CNC machining and measurement and inspection solutions.”

The MTA is now calling on a well-integrated commitment from the whole nation to help industry realise its potential, ranging from business leaders and academics to policymakers so crucial in developing a cross-party industrial strategy.

The recent Advanced Manufacturing Plan – accompanied by support worth £4.5bn – has been welcomed as a step in the right direction and an important vehicle in helping to cultivate the new technologies and industries being born, such as electrification, lightweighting, less carbon intensive materials and renewable energy.

Introducing new measures that increase exports should also be a priority and there is an unprecedented opportunity to deliver critical sovereign capabilities from public health to defending our realm.

MACH 2024

The True Impact of UK Manufacturing report will be officially launched at MACH 2024 by MTA President Tony Bowkett.

Set over five days at the NEC (15-19th April) in Birmingham, the event is the biggest in the UK’s industrial calendar and attracts over 30,000 people from the manufacturing community and more than 500 companies.

More than £200m of business is expected to be completed during the week as some of the country’s most innovative firms unveil new technologies and machines designed to boost productivity and global competitiveness.

MACH, which has a huge focus on sustainable manufacturing and carbon reduction through its six Knowledge Hubs, is also a big attraction for young people looking for a career in industry, with 3,500 students (aged between 12 and 18) set to attend the show.

Headline sponsors Lloyds Bank welcomed the findings of the latest report. David Atkinson, UK Head of Manufacturing SME and Mid Corporates, commented: “As this report highlights, manufacturing is an integral part of the UK economy, through GDP contribution, job creation, and as a source of high wages.

“When you consider the sector’s extended reach through its supply chains and beyond, you can really start to see the scale of its contribution.

“Manufacturers have demonstrated agility and resilience in the past few years of uncertainty, and we are responding by continuing to invest in partnerships in the sector that ensure it has the skills, tools and support needed to compete on a global scale.”

To download the report, please visit https://www.mta.org.uk/trueimpactreport. More information on MACH 2024 can be found here https://www.machexhibition.com.